Banks are ramping up their investments in marketing because it works.

The average credit union with over $1 billion in assets has more than tripled its marketing spending, from $1.4 million in 2011 to roughly $4.4 million in 2023. – ABA Banking Journal

In a crowded financial market, effective marketing strategies can make a real difference. Banks are finding that targeted campaigns and personalized messaging bring impressive results.

This shift reflects a growing understanding of marketing’s power to boost visibility and drive customer engagement. With more funds dedicated to innovative and data-driven approaches, banks are seeing clear returns on their marketing spend.

As the focus on strategic marketing grows, it’s clear that smart investment in this area is crucial for success.

Developing a Strong Marketing Strategy

1. Identify Your Target Audience

To build a successful marketing strategy, start by understanding your target audience. Dive into the demographics, needs, and values of both potential and current members. Consider:

- Who are they?

- What are their financial goals and challenges?

- Are they young professionals, families, or retirees?

Use surveys, market research, and member feedback to gather insights. This information helps tailor your marketing efforts to address specific needs and preferences.

2. Create a Unique Value Proposition (UVP)

A Unique Value Proposition (UVP) distinguishes your credit union from competitors. Identify what makes your credit union stand out, such as:

- Superior customer service

- Exclusive financial products

- Strong community involvement

Craft a clear and concise UVP that effectively communicates these differentiators. Ensure it resonates with your target audience and highlights the benefits they will receive.

3. Set Clear Goals and KPIs

Defining success requires setting clear goals and Key Performance Indicators (KPIs). Determine what you want to achieve with your marketing strategy, such as:

- Increased member growth

- More loan applications

- Higher engagement rates

Establish specific, measurable goals and relevant KPIs. Regularly review these metrics to ensure your strategy is on track and make necessary adjustments.

Checklist for Developing Your Marketing Strategy:

- Understand your target audience

- Craft a compelling UVP

- Set measurable goals and KPIs

Implement these strategies to develop a robust marketing approach that leverages your credit union’s strengths and addresses member needs effectively.

Digital Marketing Strategies for Credit Unions

- Website Design and User Experience: Ensure your website is accessible, secure, and easy to navigate. A mobile-friendly, fast-loading site with clear calls-to-action helps build trust and guide visitors effectively. Prioritize security features to protect member information.

- SEO for Credit Unions: Optimize your website for relevant keywords, focusing on local and credit union-specific terms. Implement both on-page (meta tags, keyword-rich content) and off-page (quality backlinks) SEO strategies. Regularly update content to improve your search engine ranking.

- Content Marketing: Create and share informative content about financial literacy, new services, and community events. Keep content updated to remain relevant and attract potential members. Use it to position your credit union as a trusted industry resource.

- Email Marketing Campaigns: Craft personalized email campaigns for onboarding new members, retaining current ones, and promoting additional services. Use segmentation and tailored messaging based on member behavior. Track metrics like open and click-through rates to refine your approach.

Leveraging Social Media and Community Engagement

Social Media Strategies

Social media is a powerful tool for credit unions. To make the most of it, focus on these key elements:

- Choose the Right Platforms: Identify where your members are most active. Popular choices include Facebook, Instagram, and LinkedIn.

- Share Relevant Content: Post content that resonates with your audience, such as financial tips, community events, and member success stories.

- Engage Actively: Respond to comments, messages, and reviews promptly. This builds trust and fosters a strong online community.

Local Community Involvement

Connecting with your local community strengthens your credit union’s presence and reputation. Consider these actions:

- Partner with Local Businesses: Collaborate on promotions or events to support local enterprises and build mutually beneficial relationships.

- Sponsor Community Events: Invest in local events such as charity runs or festivals. This increases visibility and demonstrates your commitment to the community.

- Support Local Causes: Get involved in causes that matter to your members. This could include environmental initiatives or educational programs.

Online Reviews and Reputation Management

Managing your online reputation is crucial. Positive reviews can boost your credibility, while handling negative feedback effectively is equally important.

- Encourage Positive Reviews: Ask satisfied members to share their experiences. Positive reviews can attract new members and build trust.

- Handle Negative Feedback Constructively: Address negative comments professionally and promptly. Offer solutions or explanations to resolve issues and improve your reputation.

Over 70% of consumers trust online reviews as much as personal recommendations.

— BrightLocal, 2023

Innovative Credit Union Marketing Tactics

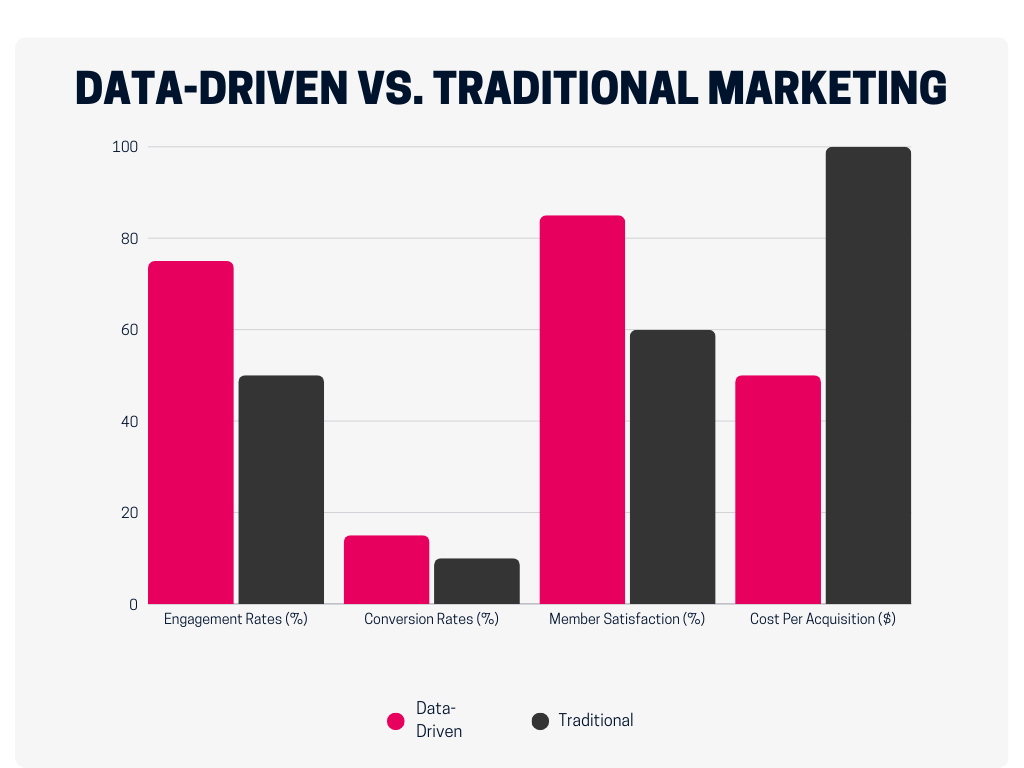

Using Data and Analytics

Leverage data-driven marketing to surpass traditional methods. By analyzing member behavior and preferences, you can make more informed decisions and target the right audience more effectively. Data-driven strategies not only enhance your marketing precision but also significantly boost overall effectiveness compared to conventional approaches.

Data provides the insights needed for targeted, effective marketing strategies.

Referral Programs and Member Incentives

Develop referral programs to reward existing members for bringing in new clients. These programs not only aid in member acquisition but also enhance loyalty among your current members by offering valuable incentives.

Personalized Member Experiences

Utilize technology to create personalized financial products and services. Tailoring experiences to individual members’ needs and preferences makes them feel valued and can significantly improve member satisfaction and retention.

Best Practices for Credit Union Marketing Campaigns

Consistency in Branding and Messaging

To establish a strong brand presence, it’s essential that all marketing materials reflect your credit union’s core values and mission. This means:

- Uniform Branding: Use consistent logos, colors, and messaging across all platforms.

- Aligned Messaging: Ensure that every piece of content reinforces your credit union’s values and goals.

A consistent brand voice helps build trust and recognition.

Regulatory Compliance in Marketing

Marketing for financial products and services requires careful adherence to legal standards. Key considerations include:

- Accurate Representation: Make sure all claims and offers are truthful and clear.

- Disclosure: Provide necessary information about terms and conditions.

Case Studies

Examining successful marketing campaigns from other credit unions can offer valuable insights. Consider:

- Successful Strategies: Identify what worked well in these campaigns.

- Lessons Learned: Apply these lessons to your own marketing efforts.

Case studies provide practical examples that can guide and inspire your strategies.

By following these best practices, your credit union can create effective marketing campaigns that are both impactful and compliant.

Future Trends in Credit Union Marketing

Digital Transformation

The landscape of marketing is shifting rapidly. Digital and mobile-first strategies are now essential. Credit unions need to invest in user-friendly websites and mobile apps. These tools help reach a wider audience and improve member interactions. Embracing digital transformation means staying relevant and competitive in today’s tech-driven world.

AI and Automation in Marketing

Artificial Intelligence (AI) is revolutionizing marketing. With AI, credit unions can personalize marketing efforts more effectively. This includes tailored email campaigns and content recommendations based on member behavior.

Chatbots also play a crucial role. They provide 24/7 support, answering routine questions and freeing up staff for more complex tasks. These technologies enhance efficiency and member satisfaction.

Sustainability and Social Responsibility

Consumers are increasingly concerned about sustainability and social responsibility. Credit unions can align their marketing with these values. Highlight your commitment to green initiatives and community support. Show how your credit union practices what it preaches.

This approach not only meets the expectations of modern members but also builds stronger, trust-based relationships.

Charting Your Path Forward: Key Takeaways for Credit Union Success

In summary, effective marketing for credit unions involves understanding your audience, crafting a compelling Unique Value Proposition (UVP), and setting clear goals. Embrace digital strategies, leverage social media, and engage deeply with your community. Use data-driven insights and personalized approaches to enhance your marketing efforts.

Credit unions must adapt and innovate to remain competitive. By staying ahead of trends and continuously refining your strategies, you can build stronger member relationships and drive growth.

Ready to take your marketing to the next level? Contact Matchbox Design Group for personalized strategies tailored to your credit union’s needs. Let’s work together to achieve your goals and make a meaningful impact.

Contact Matchbox Design Group Today!

If your website could use a refresh, if you’re looking to drive more traffic to your site, or you would like to submit a guest post, fill out the form below and we’ll contact you to learn more about your digital needs.