Estimated reading time: 12 minutes

Lead generation has become one of the biggest challenges for banks today.

People no longer choose a bank because it is close to home. They compare, research, and read reviews online before ever talking to a representative.

Fintech companies and digital-first banks have raised customer expectations, making it harder for traditional banks to stand out.

Modern lead generation is about more than technology. It is about trust, timing, and understanding what people want from their financial relationships.

This guide walks through clear, proven ways to attract interest, turn it into action, and build customer loyalty that lasts.

Related Resources

The Challenges of Banking Lead Generation

Banks face a unique mix of hurdles when it comes to generating new bank leads.

Financial products require trust, and that trust is not built overnight. Regulations limit what can be said or promoted. Most banks offer similar products, which makes it difficult to look different from the competition.

People also make financial decisions slowly.

They compare interest rates, talk to family, and think through their choices.

On top of that, the digital world is crowded. Customers see so many ads each day that many barely notice them anymore. If your message feels generic, it will disappear into the noise.

To succeed, banks need more than visibility. They need a clear strategy that earns attention and keeps it.

Defining the Goal

Lead generation for banks is not about collecting as many names as possible. It is about creating real relationships with people who trust you to guide their financial future.

Each lead is a potential long-term customer, not just another number on a list.

The goal is to generate qualified banking leads leads, increase account openings, and improve the overall value of each relationship.

Strong leads come from clear communication and consistent follow-up. When banks focus on building trust and value at every stage, growth becomes steady, and those relationships last far beyond the first interaction.

Website Optimization

Your website is often the first point of contact with potential clients. It needs to work fast, look clean, and guide users toward action.

Each product, such as savings, loans, and business accounts, should have its own landing page with clear calls to action. Make sure the site loads quickly on all devices and is easy to navigate. The smoother the experience, the more likely a visitor becomes a customer.

Search Engine Optimization (SEO)

Strong SEO helps people find your bank before they even know they are looking for it.

Focus on keywords related to your financial services and your local area.

Update meta titles and descriptions so they match user intent and read naturally in search results. Keep adding new, helpful content that answers real questions.

Over time, this consistency builds authority and keeps your brand visible where it matters most, on the first page of search results.

Digital Presence and Optimization

Your bank’s digital presence shapes how people see and trust your brand.

A strong online experience makes it easy for customers to explore services, compare options, and take action.

Every part of your online presence should feel consistent and professional. When your website, search visibility, and user experience work together, they can turn casual visitors into loyal customers.

Website Optimization

Create a site that feels clean and natural to use.

Every page should have a clear goal, whether that is opening an account, applying for a loan, or learning about business services.

Build landing pages for key products such as savings, loans, and business accounts.

Keep loading times fast and make sure the site works perfectly on phones and tablets.

Search Engine Optimization (SEO)

Help people find your bank when they search for financial services online.

Focus on keywords that match your location and your products.

Write clear meta titles and descriptions that encourage users to click through.

Keep your content current and helpful so your site continues to rank well in search results.

Geo Targeting

Use location-based strategies to connect with customers in your area.

Create local landing pages for each branch or region and include details such as addresses, maps, and service highlights.

Keep your Google Business Profiles up to date so your bank appears in local search results. This helps people nearby discover your bank when they search online.

User Experience

Design an experience that feels smooth and trustworthy.

Keep navigation simple so visitors can move from one page to another without confusion.

Shorten forms and make sign-up steps easy to complete.

Show signs of credibility such as verified reviews, security badges, and visible contact details to build trust from the start.

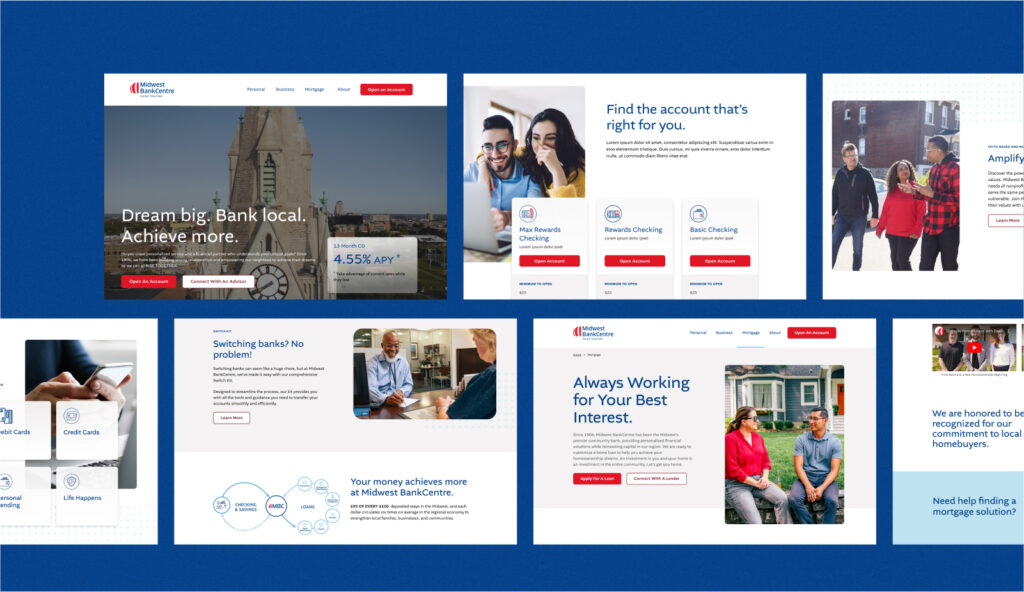

Bank Web Design Case Study: Midwest BankCentre

Content Marketing and Education

Content marketing helps your bank build trust long before someone opens an account. By sharing useful and clear information, you show that you understand your customers’ needs and can help them make smart financial choices.

Educational content positions your bank as a helpful partner, not just a service provider.

Blogs

Write blog posts that answer real questions people have about money.

Cover topics such as saving tips, mortgage basics, or small business financing. Keep each article clear and short enough to read easily but detailed enough to be helpful.

Regular blog updates improve your search visibility and keep your site feeling active and relevant.

Case Studies

Show how your bank has helped real people or businesses succeed. Case studies make your services more relatable and give potential clients a clear idea of what to expect.

Focus on the challenge, the solution your bank provided, and the outcome. Use real numbers or quotes when possible to make the story more believable.

Testimonials

Customer feedback builds credibility and trust.

Highlight genuine reviews from satisfied clients who appreciate your service and support.

Place testimonials on key pages such as your homepage and product landing pages. This helps new visitors see proof that your bank delivers on its promises.

E Books

Offer downloadable guides that teach readers about topics such as budgeting, loans, or business banking.

E Books allow you to collect contact information while providing real value in return. Keep them short, well-designed, and easy to understand.

Once someone downloads your guide, follow up with personalized content that guides them toward opening an account or meeting with a banker.

Paid Advertising

Paid advertising helps your bank reach new customers fast. It puts your brand in front of people who are already searching for financial services or exploring their options.

When managed carefully, it can drive quality traffic, boost awareness, and support long-term growth.

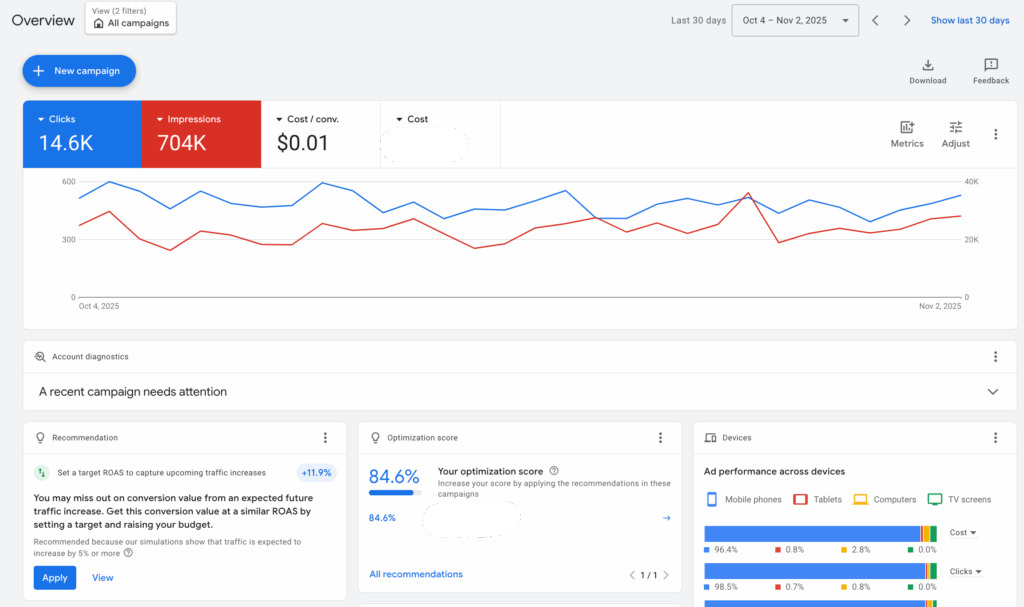

Paid ads deliver trackable and consistent results. You can measure clicks, leads, and account sign-ups to see what works best. They also allow you to reach specific audiences based on age, income, or location. This focus helps you spend smarter and get stronger returns over time.

Start by defining what you want to achieve, such as more savings accounts or loan applications. Choose the right channels, like Google Ads or Meta Ads, and craft messages that speak to your audience’s goals.

Send traffic to clear, conversion-focused landing pages. Review your data often and adjust budgets, keywords, and visuals to improve performance.

Social Media

Social platforms give your bank a personal and engaging way to connect with customers. Use them to share updates, financial tips, and community news.

Promote limited-time offers or educational resources that lead visitors back to your site. Consistent posting builds brand awareness and helps keep your bank top of mind when someone is ready to open an account.

Incentives

Customers respond to clear, meaningful rewards. Offering small perks can be a powerful way to encourage new sign-ups and strengthen loyalty among current clients.

- Interest Rates: Highlight competitive rates for savings and loans. Make the details easy to understand and show how customers can benefit.

- Cash Bonuses: Offer sign-up or deposit bonuses for opening a new account or meeting certain balance requirements. Keep the process simple and transparent.

- Online Banking Rewards: Reward customers who use digital banking tools. Provide small cash credits, fee waivers, or loyalty points for consistent online activity.

Referrals and Partnerships

Referral programs and community partnerships build trust through word of mouth. They also turn satisfied clients into advocates for your bank.

- Cash Bonus: Reward both the referrer and the new customer for participating. Small cash incentives often encourage more engagement.

- Gift Cards: Offer gift cards to local businesses as part of your referral program. This supports the community and makes the reward more personal.

- Account Credit: Provide account credits instead of physical rewards to simplify the process. It also encourages customers to continue using their new accounts regularly.

Marketing Automation

Marketing automation helps your bank stay connected with customers without constant manual effort. It allows you to send the right message at the right time, based on customer behavior and preferences.

With smart automation, you can nurture relationships, increase engagement, and increase your bank’s lead generation overall.

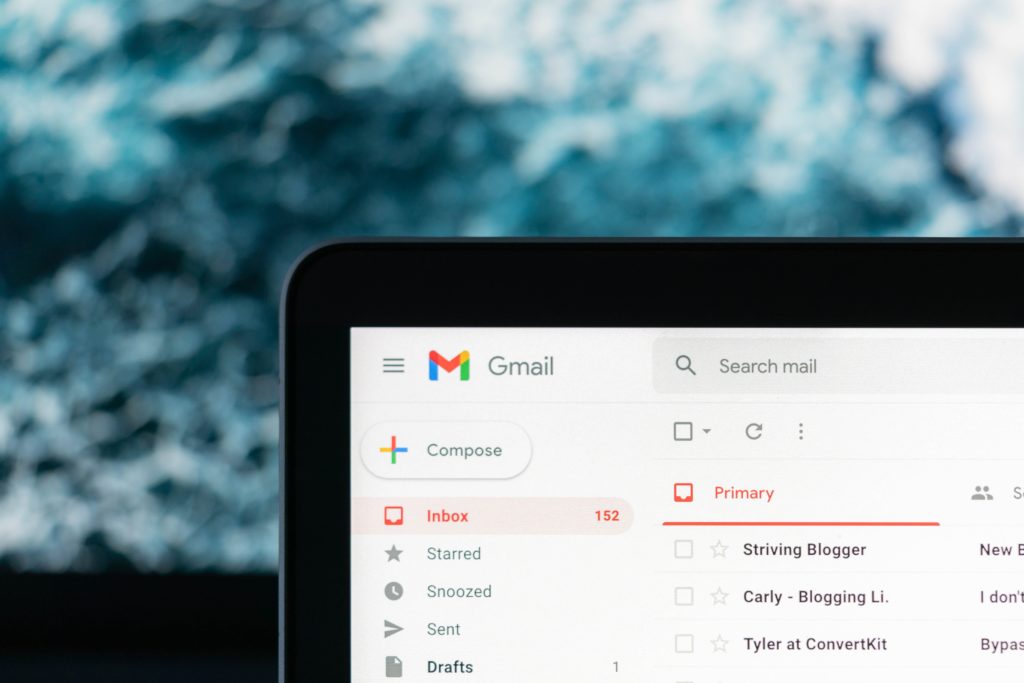

Email Marketing

Email remains one of the most effective channels for banks to reach both new and existing customers.

Use it to share updates, promote new products, and provide helpful financial insights. Segment your lists by customer type or interest so each message feels personal and relevant.

Keep the design simple and the call to action clear.

Account Updates

Automation makes it easy to send timely alerts about account activity, upcoming payments, or new features.

These messages help customers feel informed and supported. Consistent communication builds trust and shows that your bank values transparency and service.

Promotions

Automated promotions can drive quick engagement.

Use them to announce rate specials, limited-time offers, or rewards programs. Track how customers respond and adjust your timing or message based on performance. Over time, automated promotions can help turn casual interest into real conversions.

Engage with the Local Community

Community involvement helps your bank stand out and earn genuine trust.

Supporting local events, charities, and small businesses shows that you care about more than just profits.

Participate in neighborhood programs, sponsor youth sports, or host free financial education sessions.

These actions build real relationships and strengthen your reputation as a community partner.

Tailored Plans for Local Business Needs

Every community has its own mix of small businesses, startups, and entrepreneurs.

Offer customized plans that reflect local challenges and goals. Highlight flexible loan options, simple payment systems, or dedicated account managers who understand the area.

Personal attention goes a long way toward winning lasting partnerships.

Crowdfunding

Crowdfunding can help your bank support community projects and small business growth.

Consider partnering with local organizations to match donations or provide funding platforms for local causes.

This approach connects your brand with meaningful impact and positions your bank as a leader in local investment.

Niche Targeting and Specialized Services

Different audiences have different needs.

Design services for specific customer groups such as teachers, healthcare workers, or small business owners. Offer benefits that fit their financial habits and priorities.

Specialized products make customers feel seen and valued, which leads to stronger loyalty.

Constant Testing and Experimentation

Growth in digital banking depends on steady improvement. Testing helps your bank find what works best instead of relying on assumptions.

Experiment with different ad formats, page layouts, and calls to action to see which combinations deliver the strongest results. Review your analytics often and use real data to guide every decision. Small adjustments made consistently can lead to big gains over time.

Manage Online Sentiment

Your online reputation is one of your most valuable assets.

Customers often check reviews and comments before choosing a bank, so it is important to stay aware of what people are saying. Monitor feedback on search engines, social media, and review sites.

Respond quickly to both positive and negative messages with professionalism and care.

Showing that you listen and take action builds trust and turns potential problems into opportunities to strengthen your brand.

Key Takeaways: Lead Generation for Banks

- Strong lead generation for banks starts with trust and a clear digital strategy.

- A user-friendly website and optimized search presence make your bank easier to find.

- Educational content builds credibility and helps customers make confident choices.

- Paid ads and email automation drive consistent, measurable results.

- Local outreach and personalized offers strengthen community relationships.

- Constant testing helps refine your marketing and improve performance over time.

- Managing online sentiment protects your reputation and builds long-term trust.

Generating Quality Leads for Your Bank

Banks that succeed today do more than promote products. They focus on education, connection, and transparency. Each digital touchpoint is a chance to build credibility and show real value.

By blending technology with authentic community engagement, your bank can generate new leads and strengthen loyalty among existing ones. Lead generation works best as an ongoing process of listening, adapting, and improving.

The more you evolve with your audience, the stronger your results will be.