Banking ads can be a great investment, but they can also be very challenging.

PPC (Pay-Per-Click) is already difficult, and this industry adds another layer of complexity.

Should you run ads at all? How do you plan and launch a campaign? How do you optimize existing campaigns?

My goal is to lay out a comprehensive guide based on real experience that will help you plan and execute a profitable paid marketing strategy for your bank or credit union.

Should You Run Ads?

Most businesses believe that PPC will necessarily drive leads. This is not always the case.

Some audiences are large enough to be advertised to. Some aren’t.

If, for example, you are planning to run Google ads, it’s important to ensure that enough of your target audience is on the platform.

Another important factor to consider is budget.

If your bank has the money to run a campaign, then it’s a great idea. If your company is looking to throw a small amount of money towards ads, it might not give you the ROI you’re looking for.

The bottom line is this: Before running ads, ensure your audience is large enough and your budget is adequate.

Defining Your Focus

What are you hoping to get out of a campaign?

Here are some common goals we see with clients:

- New bank members

- Brand awareness

- Website traffic

- Event promotion

Establishing your goal will help with planning and execution later down the road.

What is your product/service?

How is your bank different from your competitors?

What value are you providing?

It’s important to answer these questions because they will help you with messaging and creative assets.

Conduct Research

Once you’ve laid out your goals, the next step is to do research.

Look At Your Competitors

Are your direct competitors running ads? If so, find out what they look like. Make note of their value propositions, messaging, and format.

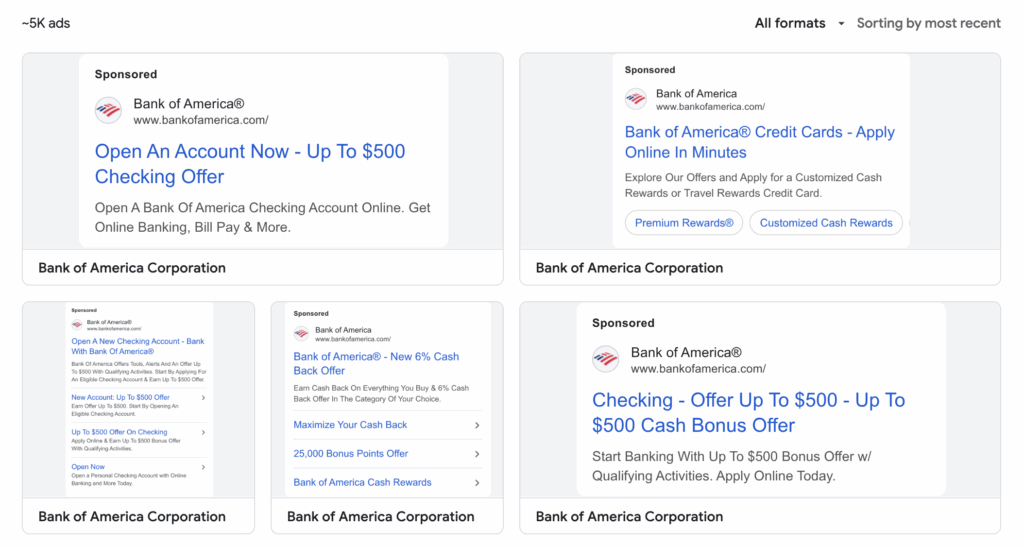

The first place I go to check if my competitors are running ads is Google’s Ad Transparency Center. Google recently started publishing all ads that are being served for transparency, which is super useful for us!

Here are some other places to check:

Try to see what types of campaigns they are running. Are they running search, display, or both?

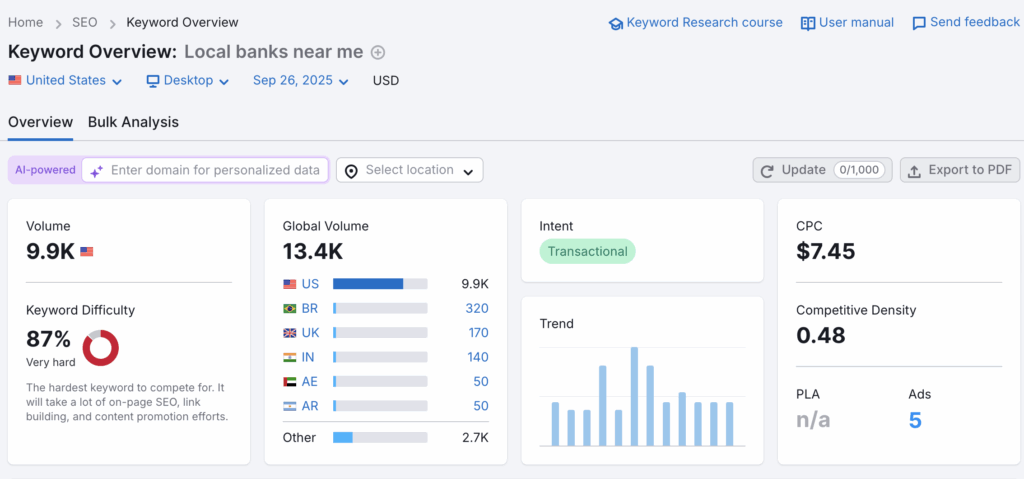

Jot down the main keywords and themes they are targeting and find out what the CPC (Cost-Per-Click) is using an SEO tool like SEMrush or Ahrefs.

Conducting this competitor analysis will help you understand what has been working other other banks and how much they are spending on PPC.

Keyword Research

Next, start compiling keywords based on your services and your audience’s pain points.

As mentioned above, you can use an SEO keyword research tool like SEMrush or Ahrefs to complete this research.

If you are on a tight budget, you can also use Google’s free Keyword Planner Tool.

Try and think about what your target audience might be entering into search engines. This can help you come up with some valuable niche keywords.

Some examples of keyword themes might be:

- Banks near me

- Best local banks

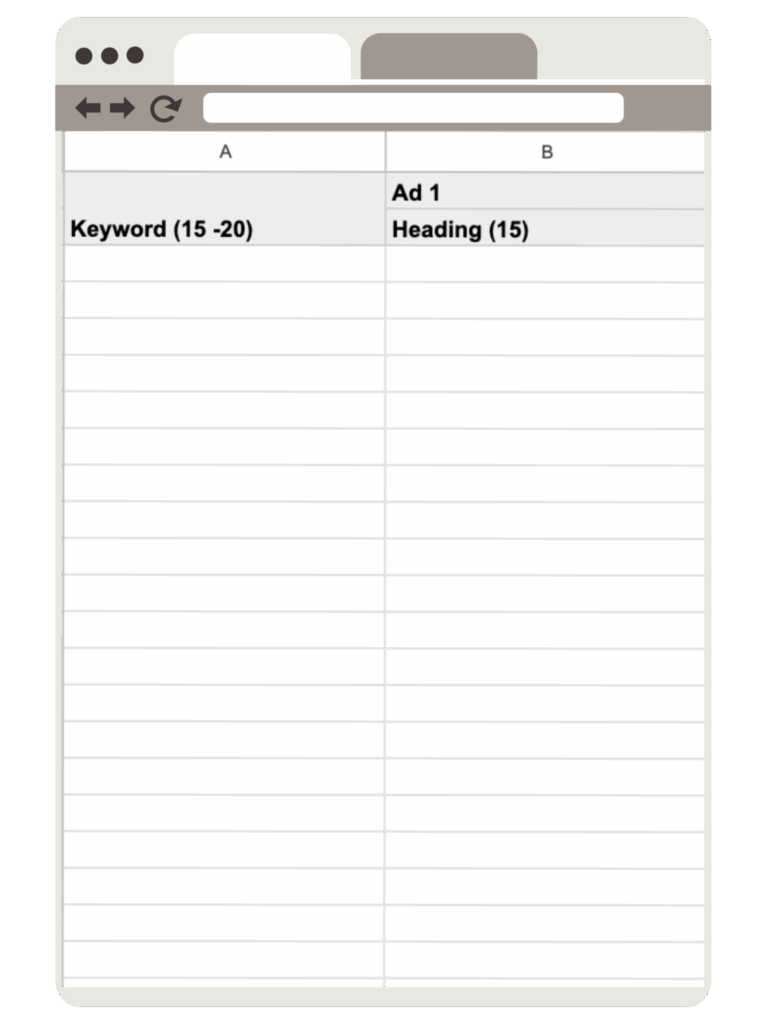

- Credit unions in my area

At this point, the more keywords the better, but later, when it’s time to build your campaign, I’d recommend trimming it down to 15-20 keywords per asset/ad group, so just keep that in mind and you’re conducting keyword research.

Choosing a Platform

After you’ve done the initial research, the next step is to choose a platform.

Google is usually a safe option, but it may be worth considering Meta, Microsoft, or LinkedIn ads.

Ultimately, you should choose the platform you think your target audience is using. If multiple competitors are advertising on the same platform, that’s an indicator that it’s a good place to run ads.

Ad Platform Policies

Before going ahead and starting your campaign, it’s crucial to check your platforms’ policies for financial services.

Once you eventually launch your campaign, all your assets will be reviewed and will be marked as either approved, disapproved, or eligible but limited.

Of course, we are shooting for approval, but if they are disapproved, the ads won’t run, and if it’s eligible but limited, it will run, but the audience may be restricted.

Note that it’s still possible to run a successful campaign despite some disapproved and limited assets. While it’s not ideal, it can definitely be done.

Choosing a Campaign Type

Now that you’ve established your focus, value propositions, conducted research, and chosen a platform, it’s time to start setting up your campaign.

The first step is to choose a campaign type. While campaign types may differ between Google, Bing, Meta, etc., they generally are as follows:

| Campaign Type | Best For |

|---|---|

| Search | Great if you want leads, detailed reporting, and a more hands-on approach |

| Display | This is a great option if your goal is brand awareness |

| PMAX | Possibly the most balanced option, offering a mix of manual control and machine learning |

| Video | Great for brand awareness and promotions |

| Smart Campaign | Set it and forget it. Smart campaigns are for those who want a hands-off approach |

In my experience, the most reliable campaign types have been PMAX and search. PMAX for its effective machine learning and search for its high lead generation potential.

Choosing a Bid Strategy

Each campaign has a set of bid strategies to choose from.

We can use our focus that we established earlier to influence our decision.

While bid strategies may vary between platforms, they generally fall into these categories:

| Goal Type | Best For |

|---|---|

| Conversion Focus | Optimized for driving leads or sales — ideal if you want measurable business results |

| Click Focus | Best if your priority is increasing traffic to your website or landing page |

| Visibility Focus | Designed to maximize impressions — perfect for brand awareness campaigns |

| Views & Engagement (Video Only) | Tailored for YouTube and video ads to boost watch time, likes, and interactions |

So which bid strategy should you use? I typically recommend starting out with a click focus (typically Maximize Clicks) in order to collect enough data for machine learning. Once your campaign has collected enough data, then that’s when I start experimenting with different strategies.

We’ll go more in-depth on that later in this guide.

Establishing a Budget

There are multiple factors to consider when setting your budget.

The main one is practical. How much is your bank willing to allocate to paid ads? Generally, a higher budget will have a better return on investment.

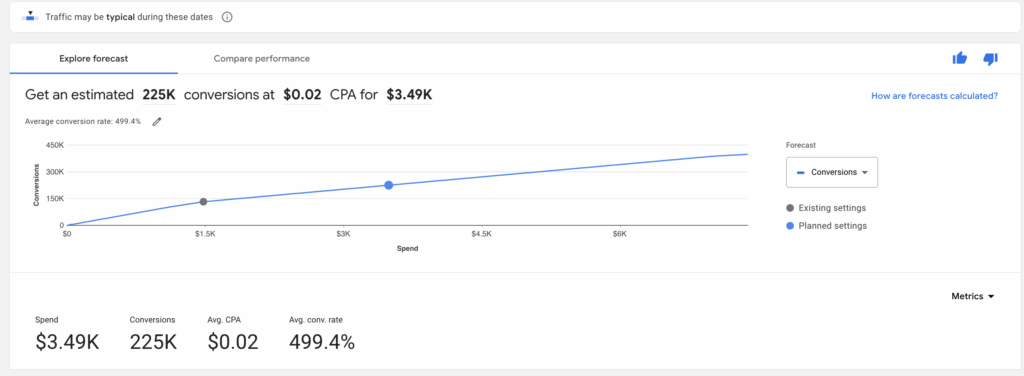

You can also use Google’s Performance Planner to get a rough idea of what your performance will look like at any given budget. Keep in mind that this tool can only give estimates.

If your company is not willing to put enough money towards ads, I usually recommend not running them at all because you’ll be wasting your budget. However, with sufficient funds, ads can be a huge lead generator.

Create Your Campaign Structure

If you’re new to PPC, figuring out how to structure your asset groups/ad groups can be confusing.

The simplest and most effective way to organize your assets is based on keywords.

Take your keyword research and organize it into different keyword themes. I recommend having at least 2-3 asset groups/ad groups, but this may differ depending on your company’s services.

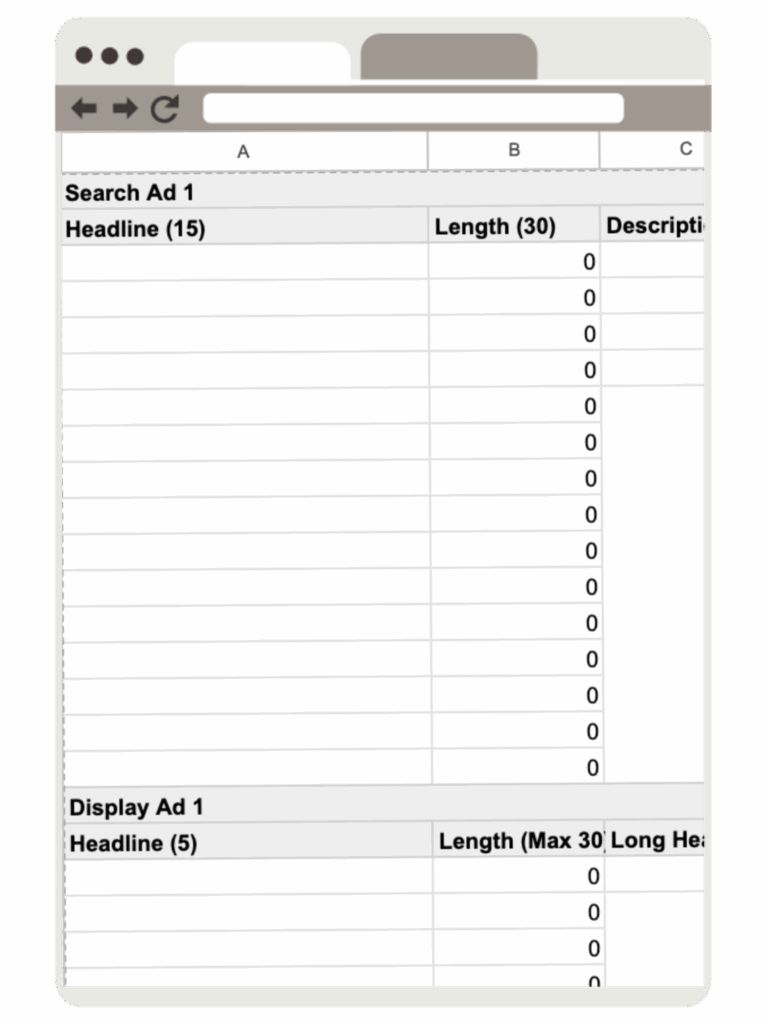

Free Google Ads Templates

These templates outline the structure we use for PMAX, Search, and Display here at Matchbox. Feel free to download them below:

Asset Creation

Now that you’ve created your campaign structure, it’s time to create assets.

Copywriting

Writing ad copy can be complicated, but there are a few fundamental principles you can stick to.

- Keep it simple

- Speak to your audience’s pain points

- Use target keywords

- Implement CTAs

While copywriting is a massive subject, if you stick to these tips, it will cover the basics.

Ad Creative

Ad creative will vary depending on the platform you are using and its image guidelines:

Audience

You can set audiences based on your bank’s existing target audience profile. However, if you’re unsure where to start, here’s a quick rundown of the life stages people are most likely to adopt new financial services.

| Audience Segment | Best For |

|---|---|

| Nest Builders & New Parents (ages 20–30) | Mortgages, personal loans, and starter credit cards — products that support early financial milestones |

| Primary/Secondary School Parents (ages 30–50) | Pensions, long-term investments, and insurance — solutions for family protection and wealth building |

| Empty Nesters & Seniors (ages 55+) | Retirement income strategies, pension growth, and decumulation planning — focused on security and stability |

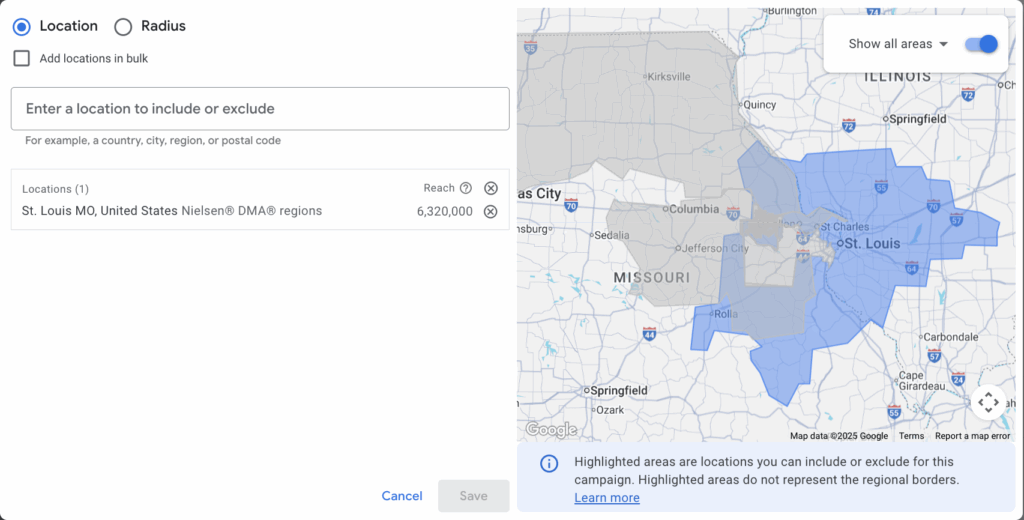

Location

Geos are pretty self-explanatory. Set the location to target areas where your target audience is.

As a rule of thumb, I recommend having a wide range of locations to start out with to help your campaign with its machine learning. If in the future, your campaign has collected sufficient data, then it’s safer to start honing in on smaller areas.

*Note – Ensure that your ads are targeting people who reside in your areas, not people who are interested or likely to visit. Most platforms have a setting where you can choose between these options.

Conversion Tracking

Tracking conversions will help your campaign’s machine learning, and it’s also very useful for reporting.

Setting up conversion tracking differs depending on what you are measuring. For example, if you are tracking form submissions, it will be different than if you are tracking calls.

Ultimately, you will need to follow the instructions given to you by your platform, but here are some resources to help you get started:

- Google Conversion Tracking

- Bing Conversion Tracking

- Meta Conversion Tracking

- LinkedIn Conversion Tracking

Launch!

After the campaign is set up, it’s time to launch.

Once it’s published, it’s important not to make any changes so as to let the algorithm learn and adjust.

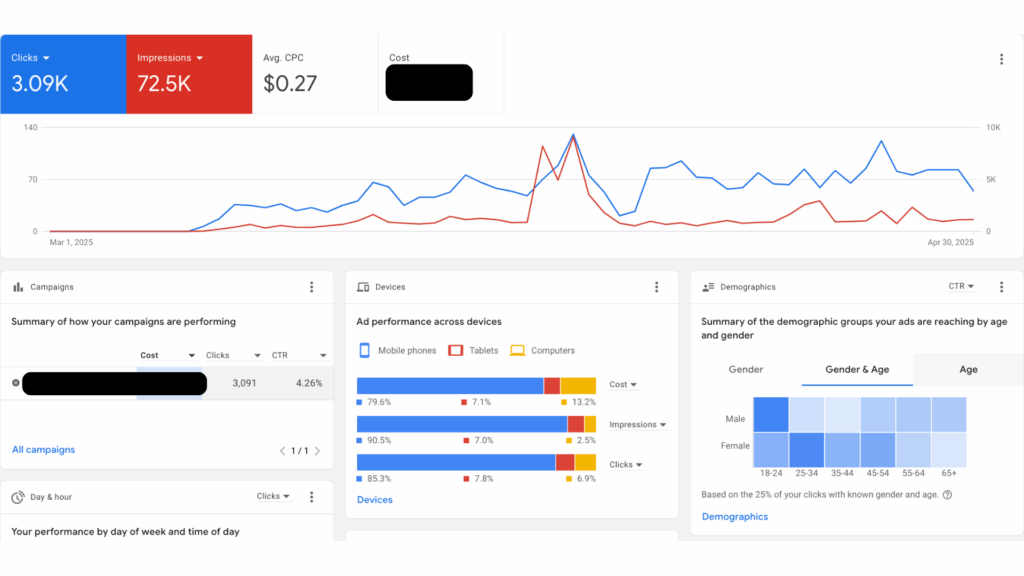

Measurement & Analysis

As mentioned above, campaigns require a minimum 30-day learning period without any changes. This will help with machine learning and optimization.

Once this period is up, then you can start digging into the data and making adjustments.

Take note of which ads are performing well and which ones aren’t.

If you’re running a search campaign, start taking out low-performing keywords and testing new ones.

Check in on your audiences, ad placements, devices, and locations as well.

Retargeting & Custom Audiences

After launching your ads, you can start building retargeting audiences.

A retargeting audience is a segment or list of people who have previously engaged with your ad/s.

These will take some time to populate, but once they do, you can apply them to your campaign to increase conversion rates.

If you have a custom list of contacts from your bank, you can also upload that to most platforms as an audience.

Late Stage Optimizations

After the ads have been running for a while, there are a few strategic adjustments you can make to maximize performance.

Bidding Strategies

As mentioned earlier, a strategy that I often use is starting a campaign with a Maximize Clicks bidding strategy, then switching to Maximize Conversions or Maximize Conversion value after you have at least 30 conversions.

This gives the campaign a period of time to collect data through Maximize Clicks. You can then use that data to start optimizing for people who are more likely to convert.

Testing

To maximize performance, constant testing is a must.

Here at Matchbox, we conduct a quarterly asset audit for all our accounts and replace low-performing images, videos, and copy.

There are many things you can test:

- Keywords

- Landing pages

- Bidding strategies

- Audiences

- Geos

- Extensions

Putting This Guide Into Action

PPC can be very challenging but very rewarding if done right. If you’d like to learn more about the intricacies of online advertising, feel free to check out some additional resources:

- How AI-Driven Reputation Management Fuels Growth for Banks and Credit Unions

- Data First Bank Marketing: Insights From Dan Novales Of 2Novas

- How Digital Innovation Is Transforming Banking: From Account Opening To Customer Experience