Estimated reading time: 1 minute

Mix & Matchbox Podcast – Episode 67

In today’s digital landscape, online reviews have become the new battleground for customer trust and loyalty. For banks, credit unions, and other financial institutions, this shift holds a great deal of importance. After all, the livelihood of these organizations depends on their reputation – the very foundation of the customer relationships that drive their success.

Yet, many financial leaders still view online reviews as a necessary evil, a “task” to be managed rather than an opportunity. But as George Swetlitz, co-founder of RightResponse AI, explains, this mindset can hold you back. “Review management is not a task,” he says. “It’s an opportunity – potentially your most important marketing and direct growth tool.”

The key lies in understanding the unique role that reviews play in the customer journey. As Swetlitz points out, “There’s no one closer to the bottom of the funnel than someone who is actually reading your reviews.” These are the customers who have done their research, found your business, and are now on the verge of making a decision. Engaging with them at this critical moment can make all the difference.

Related Links

- The Mix & Matchbox YouTube Channel

- Marketing Services for Banks & Credit Unions

- Visits Bring Value: Rethinking Your Bank Website As Digital Branch

- How Digital Innovation Is Transforming Banking: From Account Opening To Customer Experience

- Podcasting And Human-Centered Marketing: Insights From Autumn Jose Of Civista Bank

Bridging the Gap Between Ratings and Authenticity

The challenge, however, lies in striking the right balance between compliance and authenticity. In highly regulated industries like banking and finance, organizations must navigate a minefield of rules and regulations around customer communication. The temptation to resort to generic, templated responses is understandable, but it can ultimately undermine the very trust that these institutions hold so dear.

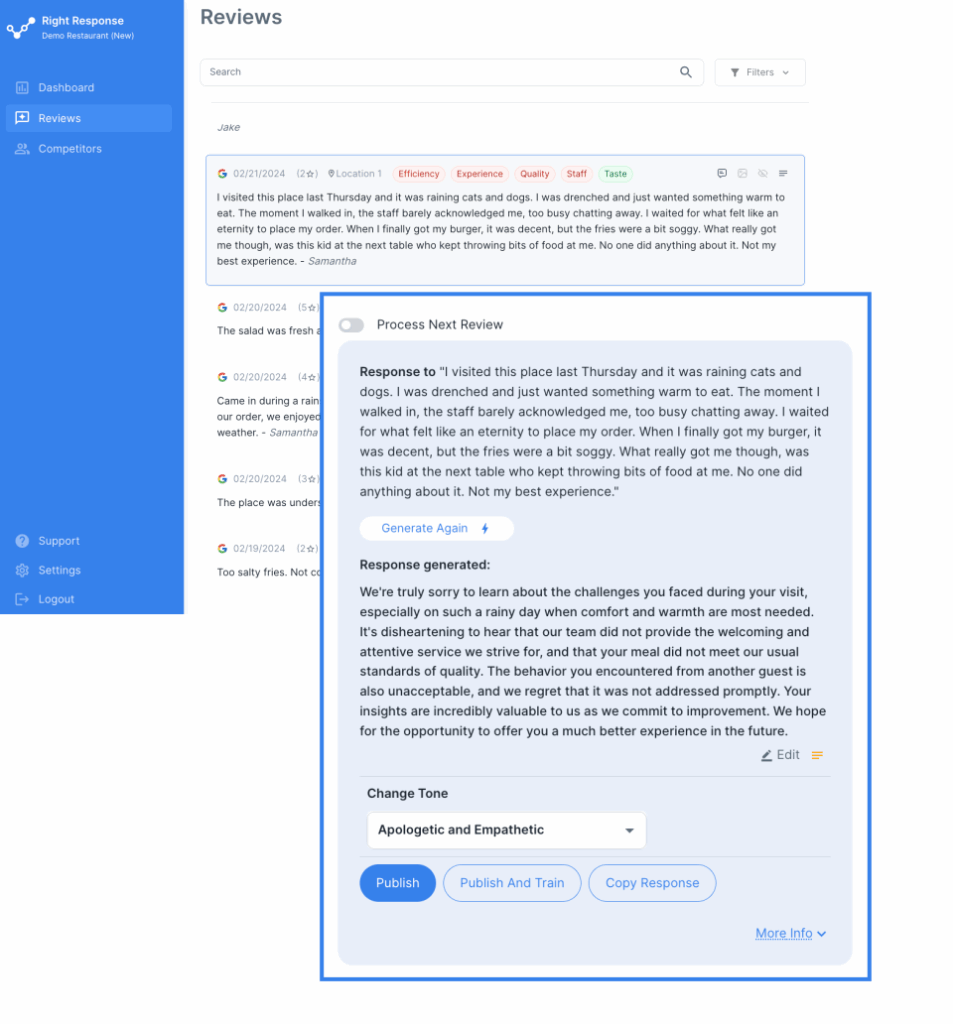

This is where AI-driven reputation management platforms like RightResponse AI come into play. By fusing advanced language models with a deep understanding of each client’s unique brand and compliance requirements, these solutions can deliver personalized, authentic responses at scale – without sacrificing regulatory oversight.

As Swetlitz explains, “AI on its own can make you sound terrible. AI that’s trained on your brand makes you sound great.” The key is in the customization, leveraging AI to extend the organization’s unique voice and messaging, while still maintaining a human review process to ensure compliance and authenticity.

Unlocking Deeper Insights from Customer Feedback

AI-powered reputation management goes far beyond writing a polished response to reviews. These tools can analyze the language, tone, and patterns in customer feedback to uncover valuable insights. Often, they surface trends and themes that traditional surveys miss—helping you better understand what your customers really think and feel.

Here are a few key insights that can be collected via AI:

- Granular Sentiment Analysis: Rather than relying solely on star ratings, which can often mask nuanced feedback, AI-powered tools can break down reviews phrase-by-phrase, identifying the specific topics and sentiments that are driving customer perceptions.

- Competitive Benchmarking: By analyzing the reviews of competitors, financial institutions can gain a deeper understanding of their strengths and weaknesses in the local market, informing strategic decisions around product, service, and customer experience improvements.

- Operational Optimization: Armed with location-level insights, branch managers can pinpoint the specific drivers of their performance, whether it’s issues with parking, teller service, or product offerings. This granular data empowers them to take targeted, data-driven action.

Ultimately, the power of AI-driven reputation management lies in its ability to transform customer feedback from a reactive “task” into a proactive growth engine. As Swetlitz puts it, “If you ignore your reviews, you’re leaving money on the table.”

The Future of Reputation Management in Banking and Finance

As AI and natural language tools continue to improve, the role of reputation management is only going to become more powerful. Swetlitz points to a future where these solutions are smarter and more connected—automatically pulling insights from reviews, surveys, chat logs, and other customer touchpoints into one clear, actionable dashboard.

For financial institutions, this kind of visibility can be a game changer. Instead of relying on scattered data or outdated surveys, they’ll have a real-time view of what customers need, want, and expect. With that understanding, banks can make better decisions about everything from product development to customer experience—all while keeping communication authentic, compliant, and trustworthy.

Of course, realizing this vision will require a shift in mindset – from viewing reviews as a necessary evil to embracing them as a strategic growth opportunity. As Swetlitz advises, “If you’re a CEO, my single piece of advice would be: take it seriously, because it could be your biggest source of growth.”

Discover the Growth Potential in Customer Feedback

Looking ahead, reputation management will only get smarter, with more automation, better insights, and seamless integration across the customer journey. The institutions that embrace this shift and treat reviews as an opportunity—not just another task—will be the ones who stand out and thrive.

Want to see how RightResponse AI is making this possible? Try it for free or book a call to explore how your institution can unlock the power of online reviews.

Key Takeaways

- Online reviews are a critical growth opportunity for banks and credit unions, not just a necessary task to manage.

- AI-driven reputation management platforms can deliver personalized, authentic responses at scale while maintaining compliance.

- Disaggregating review data can surface deeper insights around customer sentiment, competitive positioning, and operational optimization.

- The future of reputation management in banking and finance will involve increased automation, integrated data sources, and a holistic view of the customer experience.

- Embracing online reviews as a strategic priority can be a key competitive advantage for financial institutions.

Never Miss an Episode

Get more insights on design, marketing, and all things digital. Subscribe to our Mix & Matchbox YouTube channel and join the conversation.

Want to Be Featured?

We love connecting with fellow creatives, marketers, and industry pros. If you’d like to share your story or expertise on the Mix & Matchbox podcast, let’s chat.